ATF 5630.7 2007-2025 free printable template

Show details

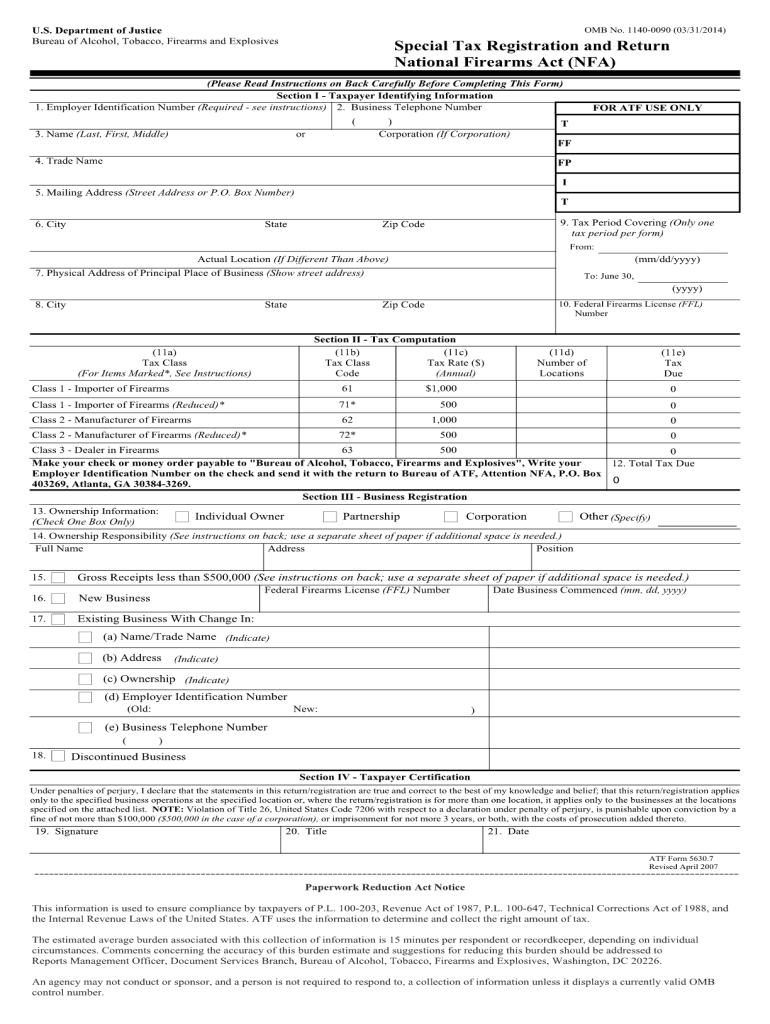

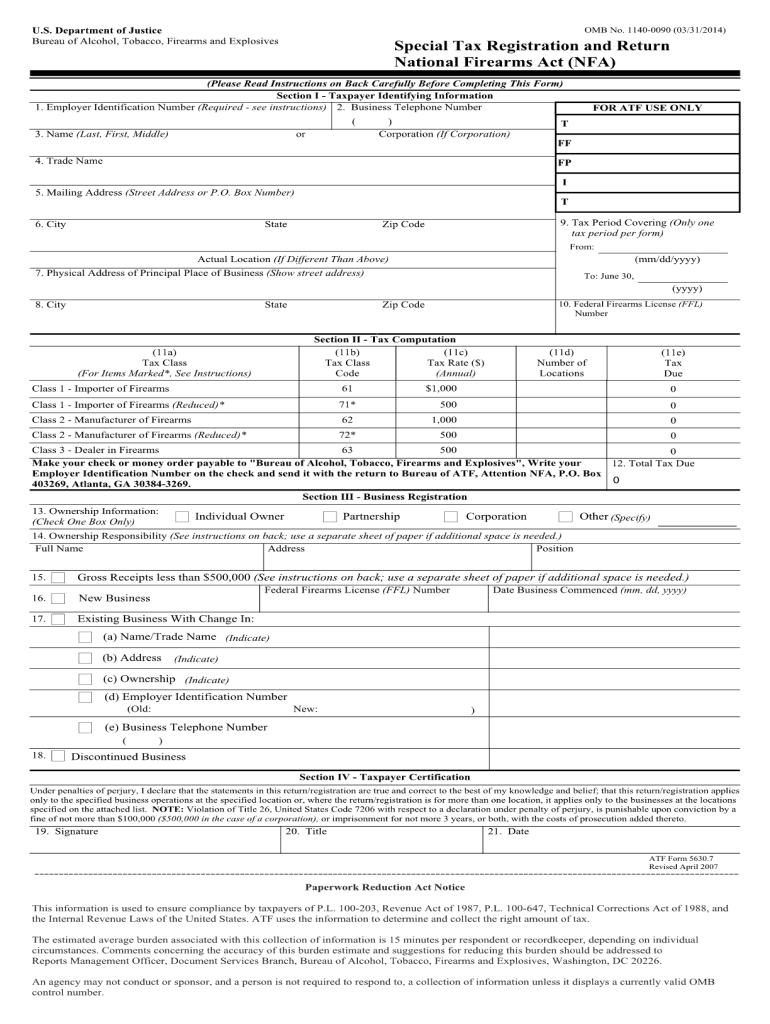

U.S. Department of Justice Bureau of Alcohol, Tobacco, Firearms and Explosives OMB No. 1140-0090 (03/31/2014) Special Tax Registration and Return National Firearms Act (NFL) FOR ATF USE ONLY (Please

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign atf 5630 form

Edit your form 5630 7 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your atf form 5630 7 instructions form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit atf 5630 7 online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit atf form 5630 7 pdf. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out atf form 5630 7

How to fill out ATF 5630.7

01

Obtain the ATF Form 5630.7 from the ATF website or a local ATF office.

02

Fill in your personal information including your name, address, and contact details in the designated fields.

03

Indicate the purpose of the form and provide any relevant details pertaining to the application or request.

04

If applicable, provide information about your business, including its name, address, and type of business.

05

Review the eligibility criteria and ensure you meet all requirements before submitting the form.

06

Sign and date the form at the bottom.

07

Submit the completed form according to the provided submission instructions (mail or electronic).

Who needs ATF 5630.7?

01

Individuals or businesses engaged in activities involving firearms or explosives that require compliance with federal regulations.

02

Applicants seeking to conduct regulated activities that are subject to ATF oversight.

03

Persons applying for permits related to firearms, ammunition, or explosives.

Fill

atf form 5630

: Try Risk Free

People Also Ask about 5630 7 form

Do you need a form 4 for a suppressor?

Purchasing a silencer, also known as a suppressor, for your firearm is a legal process that requires you to go through the silencer ATF Form 4 process. This involves filling out several forms, undergoing a background check, and waiting for approval from the Bureau of Alcohol, Tobacco, Firearms and Explosives (ATF).

What is the ATF form for buying a weapon?

Any firearm, received by a FFL, that was privately made (not manufactured by another licensee) must now be recorded on the ATF Form 4473.

Is a suppressor a form 1 or form 4?

Unless you're a federal firearms licensee (FFL), you'll need to file a Form 4 in order to purchase an NFA item such as a suppressor, short barrel rifle (SBR), short barrel shotgun (SBS), machine gun, or any other weapon (AOW).

What ATF form is needed for a suppressor?

To purchase a suppressor, you will need to find an authorized dealer in your area. Once you find the suppressor you want, the Dealer will assist you in filling out a Form 4. This is the form you will send into ATF along with the following: ATF FORM 4 (DUPLICATE)

What is ATF form for SBR?

ATF Form 1 is an “Application to Make and Register a Firearm.” It is used whenever a person without a Federal Firearms License (FFL) wants to make an “NFA Firearm” such as a silencer (suppressor), short barreled rifle (SBR), short barreled shotgun (SBS), or an Any Other Weapon (AOW).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my atf 5630 online directly from Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your atf form 5630 5r renewal and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

Can I create an eSignature for the 5630 7 in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your nfa form 5630 7 and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How do I fill out atf form 5630 7 fillable on an Android device?

Use the pdfFiller app for Android to finish your 5630 7 atf. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is ATF 5630.7?

ATF 5630.7 is a form used by entities to report donations or contributions of firearms or ammunition to certain qualified organizations, particularly in compliance with federal laws.

Who is required to file ATF 5630.7?

Individuals or organizations that contribute firearms or ammunition to qualified entities, such as law enforcement agencies or certain non-profits, are required to file ATF 5630.7.

How to fill out ATF 5630.7?

To fill out ATF 5630.7, providers must include their personal or organizational details, a description of the items donated, the date of the donation, and the recipient organization's information.

What is the purpose of ATF 5630.7?

The purpose of ATF 5630.7 is to maintain transparency and compliance in the donation of firearms or ammunition to ensure they are being used for legitimate and lawful purposes.

What information must be reported on ATF 5630.7?

The information that must be reported includes the name and address of the contributor, a detailed description of the firearms or ammunition, the date of donation, and the name and address of the recipient organization.

Fill out your ATF 56307 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Atf Form 5630 Template is not the form you're looking for?Search for another form here.

Keywords relevant to atf f 5630 7

Related to form 5630 atf

If you believe that this page should be taken down, please follow our DMCA take down process

here

.